Investment Funds in Canada (IFC) Exam

Last Update Feb 28, 2026

Total Questions : 486

We are offering FREE IFC CSI exam questions. All you do is to just go and sign up. Give your details, prepare IFC free exam questions and then go for complete pool of Investment Funds in Canada (IFC) Exam test questions that will help you more.

Which exchange in Canada deals exclusively with financial and equity futures and options?

A fund manager is selling industrial sector stocks and using the proceeds to overweight the portfolio in financial services stocks to take advantage of her belief of changes in the business cycle. What equity investing philosophy describes this approach?

Greg is a Dealing Representative. As a part of his business building activity, Greg prepares several messages to post on his website and Facebook page. Which statement CORRECTLY describes this

situation?

Last year at age 70, Gregory opened a registered retirement income fund (RRIF). Recently, Gregory unexpectedly received a large cash gift and presently does not need to depend on any payments from his RRIF. He contacts his financial advisor Eric for guidance.

Which of the following statements by his financial advisor would be CORRECT?

Marta is turning 71 years old this year. She will have to convert her registered retirement savings plan (RRSP) to a registered retirement income fund (RRIF). Which of the following statements is TRUE?

An Investor is making annual withdrawals from their mutual fund as follows:

Based on the withdrawal schedule, what type of withdrawal plan are they using?

Which of the following statements is true when comparing fund of funds to traditional mutual funds?

Ellen and her only son Jeff live on the family farm with her father George. Jeff is five years old and Ellen has decided that it is time to start saving for Jeff’s post-secondary education. She has called you to ask about registered education savings plans (RESPs).

Which of the following statements is TRUE?

Sudhir is interested in an investment where he can share corporation profits. Sudhir understands basic market mechanics and is willing to accept volatility; however, he does not consider himself a sophisticated investor. What type of underlying asset class should Sudhir consider?

A mutual fund representative misrepresents the risks associated with a particular mutual fund in order to encourage a conservative client to purchase it. What part of MFDA Rule No. 2 “Business Conduct” did the representative violate?

Fred's client, Matteo, holds a technology-themed mutual fund. The fund's investment objective recently changed, allowing it to hold various cryptocurrencies, resulting in a high-risk rating and making it unsuitable for Matteo. Fred discussed the change with his client, but Matteo insisted on continuing to hold the fund. What action must Fred take?

What term applies to unemployment created by a new technology that eliminates the need for subway train drivers?

Which feature would be of prime importance for a money market mutual fund?

Which statement about unused registered retirement savings plan (RRSP) contribution room is CORRECT?

Wilma has always used the services of a tax preparation firm to file her taxes but is skeptical that she has really benefitted. This year she plans to file her own taxes for the first time.

What would be useful for her to know?

Rebecca, an investor in a 40% marginal tax bracket, receives $1,200 in Canadian dividends eligible for the dividend tax credit. What is the dividend tax credit that applies to this income?

What statement CORRECTLY describes a key difference between bonds and debentures?

Lucas wants to participate in the Lifelong Learning Program (LLP). He currently has $10,000 in his registered retirement savings plan (RRSP) for this purpose. He plans to make his maximum permitted

withdrawal of $10,000 under the LLP in two months. Based on this information, what would be his investment objective for the $10,000 currently sitting in his RRSP?

Kendrick is a newly registered Dealing Representative for Oak Solid Financial. He has been assigned the task of contacting existing clients where there has been no record of consultation within the last 12 months. The first person he sees on his list is a client named Chandra Ruffino. He double-checks if her phone number is on the Do Not Call List (DNCL) registry. Which of the following statements apply?

What type of fee is used to compensate mutual fund sales representatives for providing ongoing services to clients?

A client had set up a voluntary accumulation plan to invest a set amount annually in December in an equity mutual fund. They decided to move to a pre-authorized plan where they will invest a smaller amount in this fund every week. What is likely the most significant benefit of this change?

Which of the following statements is TRUE about the movement of business cycles in the Canadian economy?

AWB Inc. requires new capital to finance a business opportunity. They expect to generate substantial growth from this project and repay the capital within five years. Which financial instrument should the company issue to finance this opportunity?

Darryl has a diversified investment portfolio of mutual funds in a non-registered account with Investwell Mutual Funds, a mutual fund dealer. Darryl’s diversified portfolio is composed of 3 mutual funds. Each mutual fund is currently worth about $100,000. The ABC Canadian Equity Fund has a total return of 6%, the DEF Bond Fund has a total return of 8% and GHI Global Equity Fund has a total return of 10%. Darryl wants to make an in-kind contribution to his registered retirement savings plan (RRSP) account. He has unused RRSP contribution room of $60,000.

From a tax-efficient viewpoint, which funds contribute in-kind to his RRSP account?

As per CIRO policy, what is a required step after receiving an emailed client complaint regarding dissatisfaction with a product?

A self-directed investor bases stock purchase decisions on internet recommendations and stock tips, believing this provides the most accurate information. What is the investor's behavioural bias?

Greg, one of your clients, has been advised by a friend to invest in open-end mutual funds. He is not sure about the differences between open and closed-end funds.

What would you tell Greg about open-end funds?

With respect to the tax treatment of dividends received from a taxable Canadian corporation, which of the following statements is CORRECT?

In a mutual fund sales representative's interaction with clients, what term best describes a set of moral principles that incorporate both the letter of the law and the spirit of the law?

Based on the financial planning pyramid, what security would be appropriate for a very aggressive investor?

Your client’s unused RRSP contribution room is $46,000. He contributes $15,000 in the current taxation year. How much RRSP contribution room can he carry forward?

Which of the following qualifies as personal information under the Personal Information Protection and Electronic Documents Act (PIPEDA)?

Ian is 25, employed, and has no dependents. He has no current financial or family obligations. He has asked for your recommendation for investing a $50,000 inheritance. What asset allocation would typically suit an investor with Ian’s characteristics?

Which behavioural bias causes a person to rely on a “best-fit” process to form the basis for understanding a new circumstance?

What criteria does the independent review committee use to determine if a potential conflict of interest, such as interfund trading, should be approved?

Grant is a Dealing Representative with WealthPlus Securities Inc. Grant becomes a volunteer member of his local arena's Hockey Association and is appointed as the Association's new Treasurer. Which of the

following statements about Grant's appointment as Treasurer is CORRECT?

Which money market fund yield is calculated as the most recent seven-day yield?

Your client, Rinaldo, wants to know more about the fees associated with his mutual funds. What can you tell him about a mutual fund’s management expense ratio (MER)?

Nancy received a $160 taxable dividend from Can-Star Ltd., whose shares she holds in her non-registered account. Can-Star is a taxable Canadian corporation. What is the approximate amount of the dividend tax credit Nancy will receive on the shares?

Yesterday, Mariana who is new to investing and purchased mutual funds for the very first time. She shared her excitement with her good friend, Julius. However, after Julius learned about her investment, he admits that he had a bad experience with mutual fund investing and that he lost money. Mariana regrets not talking to Julius prior to making her decision. Her feelings of enthusiasm have changed to fear. She is wondering if it is too late to change her mind and cancel her purchase order.

Which statement regarding the right of withdrawal is CORRECT?

What amount of Canadian taxes would an investor with a 33% marginal tax rate pay on a $5,000 dividend payment from a foreign corporation?

Maxine is a portfolio manager who 15 years ago, purchased 100 shares of Never2Tacky, a social media corporation for Aspirations Global Technology Fund. She purchased the stock when it was trading at $10. Last year, the peak market price was $120. Presently, it is trading at $99. News agencies are now reporting that additional regulations regarding social media companies are about to be agreed upon by G7 countries. Maxine is concerned the market value of Never2Tacky is going to drop. She buys a put option with an exercise price of $95 with an expiry of 9 months.

What type of strategy is Maxine using?

Which of the following Dealing Representatives has CORRECTLY fulfilled their suitability obligation?

Axis Wealth Management Inc. is a mutual fund dealer and member of the Mutual Fund Dealers Association of Canada (MFDA).

Indrek is a Branch Manager for the Guelph Branch and he is responsible for conducting suitability reviews in order to identify any unsuitable transactions or accounts. Which of the following

accounts/transactions would be unsuitable?

The Corporation Group is seeking financing for the purchase of new equipment for a planned expansion. They want to use the funds for a period of five years. They do not want to pledge any of their existing assets as security or extend shares to any of their debtors. Additionally, they want the privilege of repaying borrowed funds at any time if they so choose. What is the most ideal fixed-income security they should issue to raise this capital?

Which statement about a net capital loss incurred by a mutual fund trust is CORRECT?

Fabiola is an optometrist and an incorporated professional. She has fallen behind schedule regarding saving for retirement. She is considering opening an Individual Pension Plan (IPP).

What provision might encourage her to use an IPP?

Joanne’s earned income last year was $45,000 and her pension adjustment was $2,500. She has $2,000 in carry-forward registered retirement savings plan (RRSP) room for the current taxation year. What is Joanne’s maximum tax-deductible RRSP contribution amount for the current year?

Which statement best describes what a rational investor will do when comparing the risk and return of two investments?

A dealing representative explains the past performance of a mutual fund to a potential client, discussing the annual simple returns and compound returns that the fund had earned. She concluded by indicating she expects the fund’s NAVPU was likely to rise at similar rates in the future, given the economic outlook. What unacceptable selling practice has occurred?

Which security is most likely to provide a capital gain if held to maturity?

An established securities house in Quebec offers several investment products, including mutual funds and various securities (e.g., bonds and stocks). An administrative employee has brought forward a potential fund trading violation by a registered employee. Immediately following the employee's report what action is most likely to occur?

Which newspaper article would be likely to result in foreign capital moving out of a country?

Your client Jerry's asset mix is deviating from the original target asset mix because the stock market has had strong performance. Equities are now over-weighted in Jerry's account. The original target asset mix is still valid since Jerry's situation has not changed. He is invested in several bond and equity mutual funds. What should you do?

David is reviewing a simplified prospectus and is particularly interested in one of the funds. The investment objective stated for this fund is to provide dividend income, capital preservation, and some potential for capital gains. What fund is David interested in?

Lucas is 60 years old and continues to work. He presently is a plan holder of a registered retirement savings plan (RRSP). He is considering changing his RRSP to a registered retirement income fund (RRIF).

Which of the following statements is CORRECT?

What areas are addressed in the Client Relationship Model (CRM) regulation?

A sample of four portfolios is given below, with an even split between allocations 1 and 2.

Portfolios | Allocation #1 | Allocation #2

Portfolio A

Preferred shares

Common shares

Portfolio B

Treasury bills

Debentures

Portfolio C

Debentures

Common shares

Portfolio D

Treasury bills

Preferred shares

Which portfolio carries the greatest amount of risk?

If the Consumer Price Index (CPI) was 140.6 last year and 146.9 this year, what was the inflation rate over the year?

Lydia wants to transfer units of her Sussex Growth Fund to her registered retirement savings plan (RRSP) as her RRSP contribution. The current market value is $10,600 and the cost of the units is $4,500.

Which of the following statements is CORRECT?

Sheldon is a 25 year old graphic designer. He has just started working and saves regularly. Apart from his regular salary he also earns extra money from freelancing after office hours and during weekends. His earnings from his freelance work are sufficient for meeting his living expenses. He saves the entire amount of his salary. He has heard about lifecycle funds but has come to you for additional information.

Which of the following statement about lifecycle funds is TRUE?

One of your clients, Harry, has heard that he can defer paying tax on capital gains. He wants to know if what he has heard is correct and if so, how to defer paying taxes on capital gains.

What would you tell Harry?

Which index would investors use as a benchmark for doing research on the largest listed public companies in the US marketplace?

Last year, the return on YXY fund was 10.5%. It reported a standard deviation and beta of 6.5% and 1.9, respectively. Over the same period, Treasury bills and 15-year government bonds yielded 2.2% and 4.3%, respectively. What is the fund's Sharpe ratio?

Which factor is most important to consider when selecting a principal protected note (PPN)?

Janine will celebrate her 71st birthday this year. She currently has a lot of money in a personal registered retirement savings plan (RRSP) and knows there are rules about what she can do with those funds. Which of the following is TRUE?

Which of the following formulas correctly shows how taxable income is calculated?

Your client, Mrs. DaSousa, would like to diversify her portfolio by investing in a global equity fund. What should you advise her about the foreign currency risk?

Zara buys a future contract with an underlying value of $100,000 worth of stocks. She is required to deposit $1,750 of margin. Two weeks later, the underlying value of the stocks is $101,900. What is Zara's total return?

Sonya meets with her client Elijah to review different investment approaches that could be offered to help him reach his financial goals. Part of that discussion included Sonya mentioning factors such as

inflation, interest rates, and rates of return. Which stage of the Strategic Investment Planning (SIP) process does this describe?

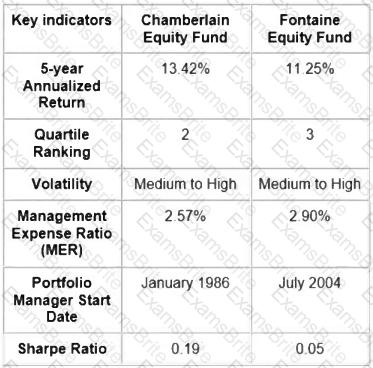

You have been researching Canadian equity mutual funds for a new client. You come across the following information.

What can you conclude from this information?

While assessing the suitability of an investment recommendation as a Dealing Representative, which statement applies to the "Client's Interest First" standard?

Douglas, aged 73, won a lottery prize of $100,000 last week. Today he contacted Vincent, his Dealing Representative, with instructions to contribute the winnings to his registered retirement income fund (RRIF) account.

Which of the following statement about RRIF is CORRECT?

Quintin has been a Dealing Representative for Global Maximum Financial for 5 years. Today, he opened an account for his new client, Reginald. In addition to opening a new account, Reginald agreed to

accept Quintin's investment recommendation and placed a purchase order to buy units of the Global Maximum Value Equity fund.

Quintin informed his Branch Manager Lupita about this new account on the same day the purchase order was received. Lupita told Quintin that she would complete her review of the New Client Application Form (NCAF) by no later than tomorrow.

Which statement regarding this new account opening is CORRECT?

Jack and Jill hold a mutual fund account as tenants in common. What conditions would apply to their account?

Should either die, full ownership of the account would pass to the other

Each would be the owner of 50% of the account’s assets

Either could issue trading instructions on all account assets

Each would be required to provide KYC information

What focus within the Standard of Conduct addresses unsolicited client orders?

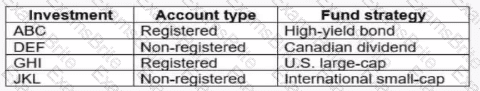

Matthew is planning on making the following investments in December:

Assuming all four investments have performed well throughout the year, which investment will trigger the highest unexpected taxes?

Which form of investment income is taxed at an investor’s marginal tax rate?

Michael had invested in several mutual funds, most of which have appreciated in value. He is not sure if he needs to report the gain as capital gains when he files his income tax return.

What would you tell Michael?

An investor deposits $80,000 in a 10-year, segregated fund contract worth $50,000 at maturity; assuming the contract guarantee is set at 75%, how much will the investor be paid (maturity guarantee)?

Catarina is a Dealing Representative for Ethical Financial which represents 20 different mutual fund families. Darlene is a fund manager from one of those mutual fund families and wants to send a gift card to Catarina as a symbol of appreciation. Ethical Financial's policies and procedures manual (PPM) require that Catarina decline the gift.

What method of addressing conflict of interest is being used by Ethical Financial?

What is the characteristic of a Stage 2 – Family Commitment investor that most affects the ability to save for the long term?

Which type of fixed income fund has a short duration, with the objectives of preserving capital and generating better current income than a money market fund?

Michael is trying to determine how much his investments will need to grow to provide for his retirement income. He would like to ensure that his projections factor in the need to maintain purchasing power. What form of return should Michael use in his analysis?

What bias results in investors valuing an asset that they own over an asset that another individual owns?

Reagan has accepted a role to be the Chief Revenue Officer of a charitable organization. She is currently registered as a Dealing Representative for Sunshine Financial Services.

Which of the following would apply to her?

Your client has very limited investment knowledge and is confused about what is meant by "marginal tax rate". What do you tell him?

In which province must registered dealing representatives notify their securities administrator of a personal bankruptcy?

What do Guaranteed Income Supplement (GIS) and Allowance for the Survivor have in common?

What is the national self-regulatory organization (SRO) for investment dealers?

The portfolio manager of the High Income Fund has 90% of the mutual fund invested in bonds. What is a reason for holding bonds in a mutual fund portfolio?

10 years ago, Felipe opened a registered retirement savings plan (RRSP) account and purchased a mutual fund. The mutual fund purchased included a 7-year deferred sales charge (DSC). At the time of making his investment, him and his Dealing Representative agreed that he had a 25-year growth objective. Since Felipe knew that he was not planning to use his investment until he retired, he was not

concerned about the DSC. Although the rate of return did vary from year-to-year, he never noticed his mutual fund having a drop in value. This gave Felipe more confidence in the investment. As a result, he has never made any changes to his investment.

What category of Know Your Client (KYC) information has been given?

Which among the following BEST describes a company's retained earnings statement?

Dave purchases 10,000 units of a no-load US-dollar denominated mutual fund for US$15 per unit for a total cost of $165,400 Canadian. He later sells the units for US$16 per unit, with a loss of $11,400 Canadian. To what type of risk has Dave been exposed?

A mutual fund sales representative receives a client’s purchase order for equity mutual funds and confirms that the order is appropriate based on the client’s recorded investment knowledge and risk tolerance. The client explains that she had inherited the funds from a family member. The client states her investment objective to be long term. The representative records this information and processes the order. What the representative doesn’t know is that the client has recently lost her job and is living on unemployment insurance. What step did the representative need to take in order to uphold her duty of care?

Four fund managers are comparing their quartile rankings over the past four years:

Which fund manager would likely be most satisfied with their fund's performance history?

Taylor is chatting with other parents in the park when the conversation turns to registered education savings plans (RESPs). Taylor thinks that most of what they are saying is incorrect. Which of the following

statements about self-directed RESPs is TRUE?

Sarah and Kyle are a married couple. They are both 34 years of age and work as teachers. Their combined annual income is $130,000. They are able to save $800 each month. They own a home worth $340,000 with a $120,000 mortgage. Since they work for the same employer, they have the same defined benefit pension plan. Other than a tax-free savings account (TFSA) in Kyle’s name with $5,000, they do not have any other assets.

They are avid sailors and want to save towards a purchase of a sailboat. For the type of sailboat they want, they estimate it should cost around $65,000. They want you to recommend an investment for their monthly savings to help them achieve their goal faster.

What question should you ask them next?

Ai Fen has recently become registered to sell mutual funds with Acadian Eastern Financial, a mutual fund dealer. Ai Fen determined that with her background of being a Chartered Financial Analyst, she can help people understand the nature of investing more easily than others in her field.

Which registration category will need to be prominently noted on Ai Fen’s business card to comply with the “holding out rule”?

What items are typically classified as current assets on the statement of financial position?

Your employer has a contributory group RRSP under which he matches employee contributions, up to a maximum of 5% of salary.

Which of the following statements about a group registered retirement savings plan (RRSP) is CORRECT?

Your client, Cosmo, recently inherited $50,000 from his uncle. He wants to use this money towards his retirement savings. Cosmo is a 50-year old, self-employed carpenter and he earns on average $65,000

per year. He has a registered retirement savings plan (RRSP) with the bank worth $425,000 and a tax-free savings account (TFSA) worth $46,000. He started saving when he was 25 years old and has always

made his own investment decisions. His money is mostly invested in balanced funds. He feels most comfortable with these types of mutual funds since they offer potential investment growth but without being too aggressive. Cosmo has no other assets.

What additional information do you need about Cosmo to fulfill your know your client obligation?

Megan purchases a treasury bill for $98,200. When it matures for $100,000, how does Megan treat the $1,800 difference?

Ayra believes the Canadian economy will be booming for the next five years. Which mutual fund can provide Ayra with the most tax efficiency if she keeps her investment in a non-registered account?

Cristina wants to add a mutual fund to her portfolio offering dividend income. She is considering either a preferred dividend fund or a standard equity fund. What is an important difference for Cristina to consider when comparing these two types of funds?

Julia is looking for a mutual fund that will give her growth with moderate volatility. Her dealing representative has suggested the Laurentian Fund. The mutual fund's mandate limits the amount of equity exposure in the portfolio to 60%. Also, the portfolio must hold between 40 - 60% in fixed income at all times. The mutual fund distributes interest, dividends, and capital gains to its unitholders. What type of mutual fund is the Laurentian Fund?

Carol contributed $500 to her TFSA. $350 was invested in ABC Bank Canadian equity fund and $150 in the ZYX Global growth fund. The expected return for the funds is 8% and 9.8%, respectively. What is the expected return on her TFSA?

Tristan is evaluating different mutual fund options for his client. What mutual fund option would be the most expensive to buy in dollar terms?

Which of the following CORRECTLY describes a material conflict of interest that has been properly addressed by the Dealing Representative?

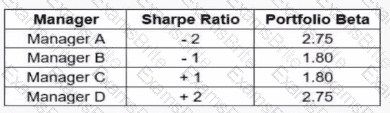

The following chart outlines data for various fund managers:

Which manager likely has the highest return for a given level of risk?

What personal information must be obtained from clients opening a non-registered account?

Date of birth

Social insurance number

Permanent address

Full legal name

What bias would influence an investor’s decision to continue to hold an unprofitable investment despite little likelihood of an improvement in the investment’s value?

One of your clients, Fernando, is approaching 71 years of age and has a few questions regarding life income funds (LIFs).

Which of the following statements about LIFs is TRUE?

When comparing mutual funds, what information would help a Dealing Representative determine a suitable mutual fund for a client?

Winter is a Dealing Representative with Top Tier Investing, a mutual fund dealer and member of the Mutual Fund Dealers Association of Canada (MFDA). Which of the following statements about Winter's

suitability obligation is CORRECT?

Winter is required to make a suitability determination every time:

i) she makes a recommendation to a client

ii) a client's investment returns decline.

iii) she opens a new client account

iv) the markets fluctuate.

Every February, Reginald, a Dealing Representative, feels pressured by his Manager to generate new registered retirement savings plans (RRSP) and contributions to assist the branch in meeting broader business targets. Reginald is nearing the end of February, and he has a meeting with a new client, Orel. Orel wants to open a tax-free savings account (TFSA) to develop emergency savings because he does not want to worry about his withdrawals being taxed. Reginald suggests that if Orel were to contribute to an RRSP first, then the resulting tax savings could be used to fund a new emergency account.

In relation to account suitability, what can be said about Reginald’s advice?

Sandra presently participates in her employer-sponsored defined contribution pension plan (DCPP). As contributions continue to be made into her plan, what can she expect?

Solomon is a Dealing Representative who is excited about a new equity fund his dealer recently approved. He thinks investors will be attracted to the fund’s historical performance. He has a prospective new client, Madira, who is 25 years old. Madira has invested in mutual funds before, but not with Solomon’s dealer. She has made an appointment to open a new RRSP with Solomon’s firm.

What does Solomon need to do to make this a suitable recommendation?