Microsoft Dynamics 365 Finance

Last Update Feb 28, 2026

Total Questions : 345

We are offering FREE MB-310 Microsoft exam questions. All you do is to just go and sign up. Give your details, prepare MB-310 free exam questions and then go for complete pool of Microsoft Dynamics 365 Finance test questions that will help you more.

You need to address the employees issue regarding expense report policy violations.

Which parameter should you use?

You need to address the posting of sales orders to a closed period.

What should you do?

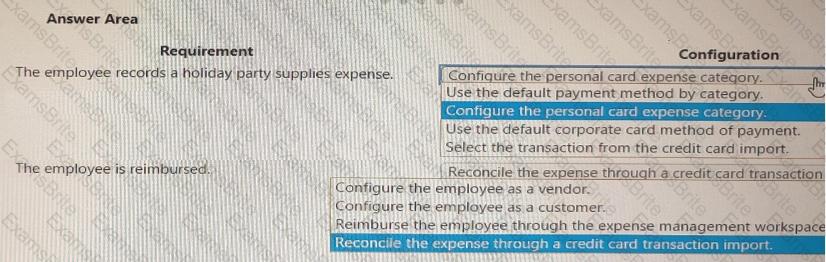

You need to configure the expense module for reimbursement.

How should you configure the expense module? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to configure the system to meet the fiscal year requirements. What should you do?

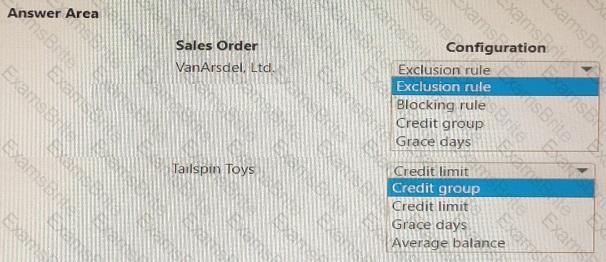

You need to identify why the sales orders where sent to customers.

Which configuration allowed the sales orders to be sent? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct select is worth one point.

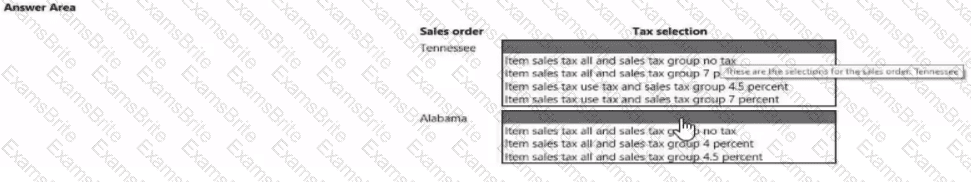

You need to validate the sales tax postings for Tennessee and Alabama.

Which tax selections meet the requirement? To answer. select the appropriate options in the answer area

NOTE: Each correct selection is worth one point.

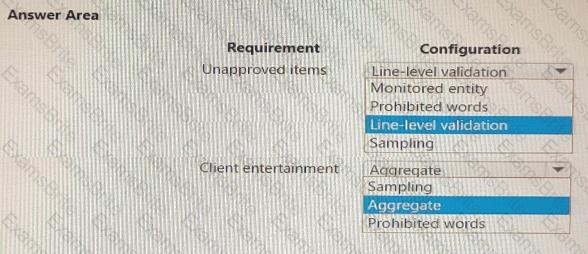

You need to prevent prohibited expenses from posting.

Which configurations should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

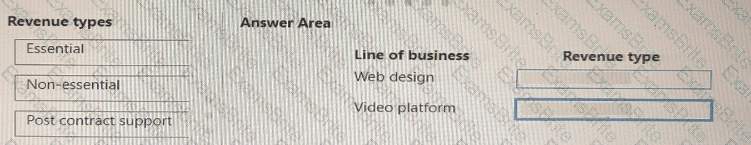

You need to configure recognition.

Which revenue type is associated with the line of business? To answer, drag the appropriate revenue types to the correct lines of business. Each revenue type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need in BUI that captured employee mobile receipts automatic ally match the transactions to resolve the User1 issue.

Which feature should you enable?

You need to identify the posting issue with sales order 1234.

What should you do?

You need to configure revenue recognition to meet the requirements.

Which configuration should you use? To answer, drag the appropriate configurations to the correct requirements. Each configuration may be used once, more than not at all. You may need to drag the split bar between panes or scroll to view content

NOTE: Each correct selection is worth one point

You need to configure Accounts Receivable to take pre-orders.

Which feature should you use?

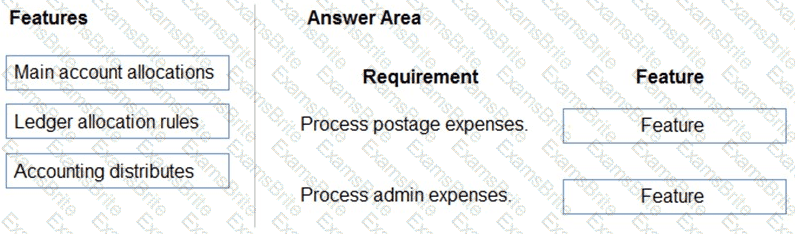

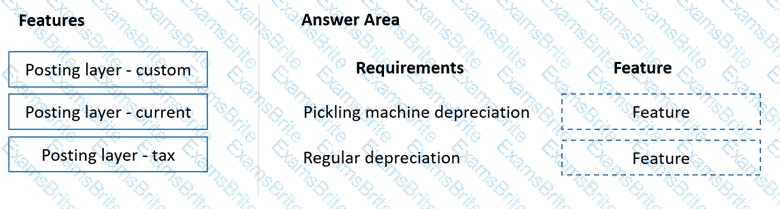

You need to process expense allocations.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or net at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to acquire the fixed assets that are associated with the purchase orders.

What should you do?

You need to recommend a solution to prevent User3's issue from recurring.

What should you recommend?

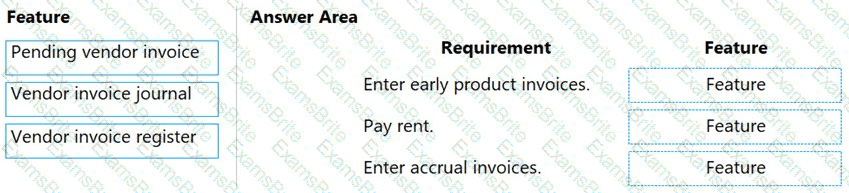

You need to configure the system to meet invoicing requirement.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to select the functionality to meet the requirement.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

The Canadian franchise purchases excess ski equipment from the US franchise. Two sets of skis are

purchased totaling USD1,000.

When the purchase invoice is prepared, USD10,000 is keyed in by mistake.

Which configuration determines the result for this intercompany trade scenario?

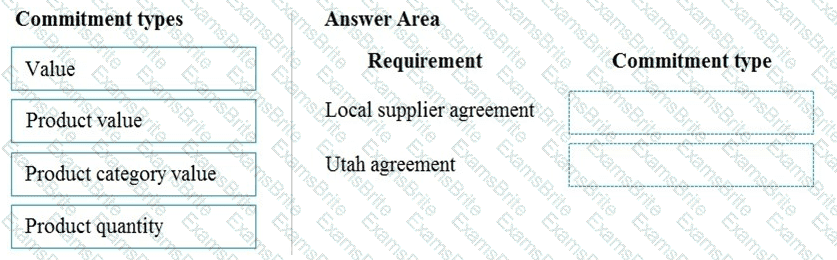

You need to configure the system to for existing purchasing contracts.

Which commitment types should you use? To answer, drag the appropriate commitment types to the correct requirements. Each commitment type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to prevent the issue from reoccurring for User5.

What should you do?

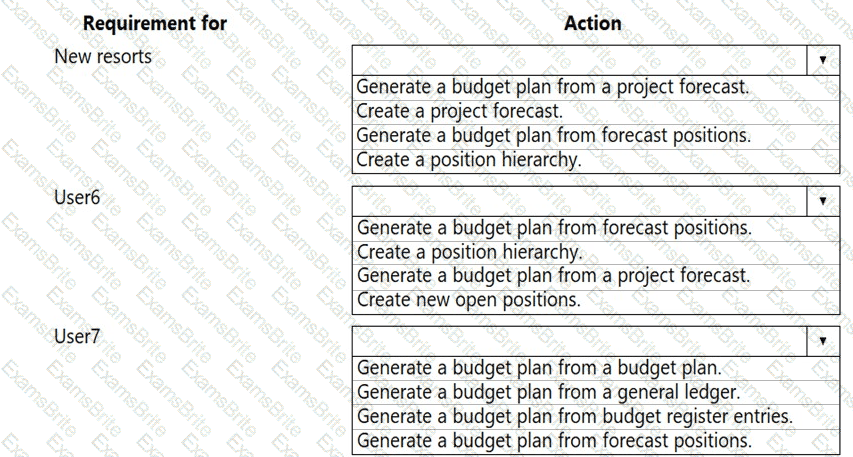

You need to configure the system to meet the budget preparation requirements.

What should you do? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to configure budget planning for Alpine Ski House Corporate.

Which two components should you configure? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

You need to determine the cause of the issue that User1 reports.

What are two possible causes for the issue? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

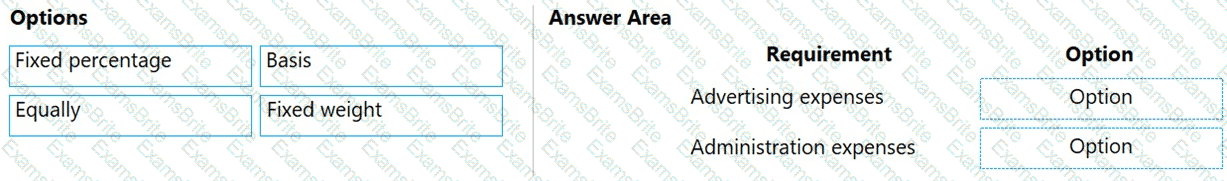

You need to configure ledger allocations to meet the requirements.

What should you configure? To answer, drag the appropriate setups to the correct requirements. Each setup may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You are the accounts receivable manager of an organization. The organization recently sold machinery to a customer. You need to registers transaction for the sale of the machinery by using a free text invoice for fixed assets. Which transaction type should you use?

You are a functional consultant for Contoso Entertainment System USA (USMF).

USMF recently opened a new bank account in the Brazilian currency.

You need to create a new bank account in the system for the new bank account.

To complete this task, sign in to the Dynamics 365 portal.

You are using Microsoft Dynamics 365 finance

You need to acquire a fixed asset.

What are three possible ways to achieve the goal? Each correct answer presents a complete solution

NOTE: bath collect selection is worth one point.

You need to adjust the sales tax configuration to resolve the issue for User3.

What should you do?

A company uses Dynamics 365 Finance.

The customer payment journal must only be available for selection by the accounts receivable user group.

You need to configure the accounts receivable journal name to meet the requirement.

Solution: Configure the journal approval.

Does the solution meet the goal?

You are implementing Dynamics 365 Finance. You configure an invoice validation policy to use three-way matching and use a three percent tolerance for invoice totals.

A user enters a vendor invoice journal. The invoice validation policy is not applied.

You need to troubleshoot the policy.

What is the issue with the policy?

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution. Determine whether the solution meets the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

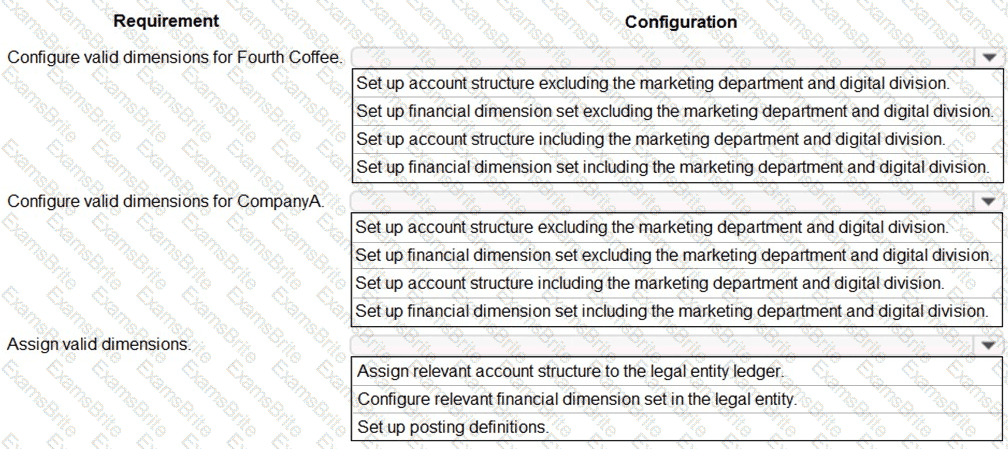

A customer uses Dynamics 365 Finance.

The controller notices incorrect postings to the ledger entered via journal.

The system must enforce the following:

Expense accounts (6000-6998) require department, division, and project with all transactions. Customer dimension is optional.

Revenue accounts (4000-4999) require department and division and allow project and customer dimensions.

Liability accounts (2000-2999) should not have any dimensions posted.

Expense account (6999) requires department, division, project and customer dimensions with all transactions.

You need to configure the account structure to meet the requirements.

Solution:

Configure one account structure.

Configure an advanced rule for Liability accounts (2000-2999) not to display any dimensions when selected.

Configure an advanced rule for Expense account (6999) to require customer.

Configure the structure with all dimension fields containing quotations.

Does the solution meet the goal?

A company uses expense management in Dynamics 365 Finance. The company has two legal entities.

CompanyA reimburses employees for travel-related expenses. CompanyB plans to reimburse remote employees monthly for travel-related expenses. All employees are required to complete expense reports.

You need to configure the expense type that can be used for both companies. Which expense type category should you use?

A company uses Dynamics 365 Finance. The company sells extended warranty services that use a project fee journal.

You need to recognize unearned revenue for the extended warranty service over time.

Solution: Configure the project ledger posting for the fee category to post to the unearned revenue account set up an accrual scheme, and use the general journal with the accrual scheme to recognize the unearned revenue.

Does the solution meet the goal?

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client has one legal entity, two departments, and two divisions. The client is implementing Dynamics 365 Finance. The departments and divisions are set up as financial dimensions.

The client has the following requirements:

Only expense accounts require dimensions posted with the transactions.

Users must not have the option to select dimensions for a balance sheet account.

You need to configure the ledger to show applicable financial dimensions based on the main account selected in journal entry.

Solution: Configure two account structures: one for expense accounts and include applicable dimensions, and one for balance sheet and exclude financial dimensions.

Does the solution meet the goal?

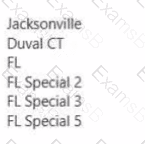

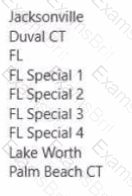

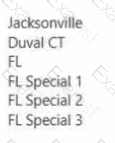

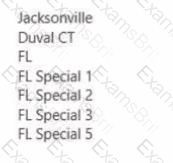

A company uses Dynamics 365 Finance for sales tax calculation and reporting. You have configured the sales tax code, sales tax group, and item sales tax group: The JAX sales tax group includes the following tax codes:

• Jacksonville

• Duval CT

• FL

• FL Special 1

• FL Special 2

• FL Special 3

• FL Special 5

The default item sales tax group includes the following tax codes:

• Jacksonville

• Duval CT

• FL

• FL Special 1

• FL Special 2

• FL Special 3

• FL Special 4

• Lake Worth

• Palm Beach CT

You assign the JAX sales tax group as the sales tax group, and default item sales tax group on the sales order. You need to select the tax code used for tax calculation on the sales order.

What should you choose?

A)

B)

C)

D)

A client has multiple legal entities set up in Dynamics 365 for Finance and Operations. All companies and data reside in Finance and Operations.

The client currently uses a separate reporting tool to perform their financial consolidation and eliminations. They want to use Finance and Operations instead.

You need to configure the system and correctly perform eliminations.

Solution: Set up Elimination rules in the system. Then, run an elimination proposal. Configure the rules to post to any company that has Use for financial elimination process selected in the legal entity setup.

Does the solution meet the goal?

You manage fixed assets using Microsoft Dynamics 365 Finance.

You need to define capitalization thresholds.

Which page should you use?

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

You manage a Dynamics 365 Finance implementation.

You must provide the budget versus actual reporting in near real time.

You need to configure the ledger budgets and forecasts workspace to track expenses over budget and revenue under budget.

Solution: Configure an expense dimension set. Configure the set show amounts field value to per budget cycle.

Does the solution meet the goal?

A company plans to create a new allocation rule for electric utilities expenses. The allocation rule must meet the following requirements:

* Distribute overhead utility expense to each department.

* Define how and in what proportion the source amounts must be distributed on various destination lines.

You need to configure the allocation rule. Which allocation method should you use?

You need to determine why CustomerX is unable to confirm another sales order.

What are two possible reasons? Each answer is a complete solution.

NOTE: Each correct selection is worth one point.

You need to troubleshoot the reporting issue for User7.

Why are some transactions being excluded?

You need to prevent a reoccurrence of User2’s issue.

How should you configure the system? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client has multiple legal entities set up in Dynamics 365 for Finance and Operations. All companies and data reside in Finance and Operations.

The client currently uses a separate reporting tool to perform their financial consolidation and eliminations. They want to use Finance and Operations instead.

You need to configure the system and correctly perform eliminations.

Solution: Select Consolidate with import.

Does the solution meet the goal?

You need to ensure Trey Research meets the compliance requirement.

Which budget technology should you implement? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point

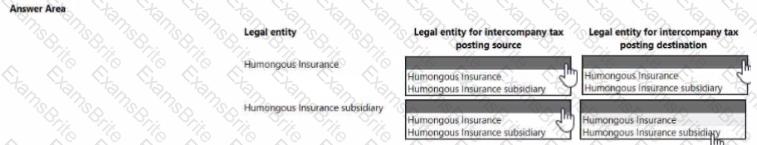

You need to reconfigure the taxing jurisdiction for Humongous insurance's subsidiary What should you do?

You need to configure the posting groups for Humongous insurance s subsidiary. Which ledger posting group field should you use?

You need to configure the cash flow management reports.

How should you configure cash flow management? To answer, select the appropriate options m the answer area.

NOTE: Each correct selection is worth one point.

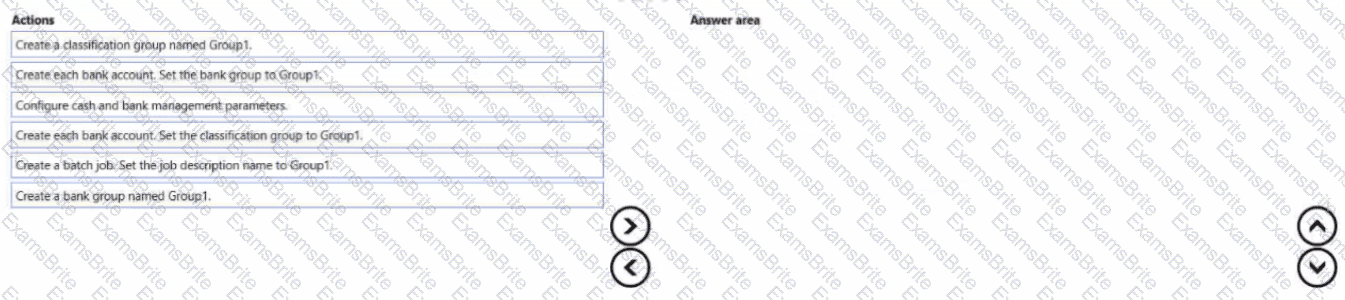

You need to create Trey Research s bank accounts.

Which three actions should you perform in sequence? To answer move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

NOTE: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select.

You need to configure credit card processing for all three companies.

Which option should you use? To answer, select the appropriate options in the answer area

NOTE: Each correct selection is worth one point.

You need to configure credit card processing for all three companies

Which option should you use? To answer, select the appropriate options m the answer area

NOTE: Each correct selection is worth one point.

You need to configure expense management tor Humongous Insurance and its subsidiary. Which options should you use? To answer select the appropriate options in me answer area

NOTE: Each correct selection is worth one point.

You need to configure currencies for the legal entities.

configure currencies? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to configure the fiscal year calendars for each legal entity.

How should you configure the fiscal year calendars? To answer, select me appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to ensure the promotional gifts are posted to the correct account. What should you use?

You need to ensure accounting entries are transferred from subledgers to general ledgers.

How should you configure the batch transfer rule? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

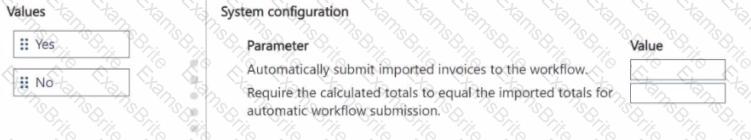

You need to resolve the accounts payable manager issue and resolve the user acceptance testing bug reported by the accounts payable clerk.

How should you configure the system? To answer, move the appropriate Value to the correct Parameter. You may use each Value once, more than once, or not at all. You may need to move the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to set up financial reports to meet management requirements. What should you do? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

You need to enforce financial budgets for management and resolve User As issue. What should you do?

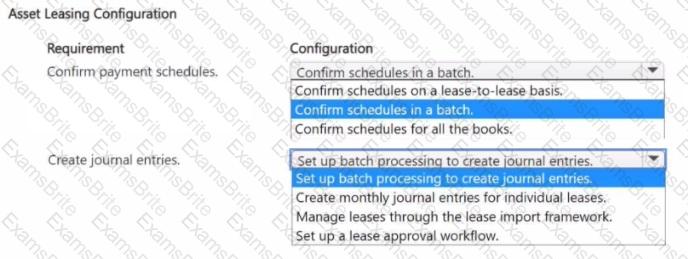

You need to resolve the issue related to monthly lease expenses.

How should you configure asset leasing? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.