ClaimCenter Business Analyst - Mammoth Proctored Exam

Last Update Jan 21, 2026

Total Questions : 50

We are offering FREE ClaimCenter-Business-Analysts Guidewire exam questions. All you do is to just go and sign up. Give your details, prepare ClaimCenter-Business-Analysts free exam questions and then go for complete pool of ClaimCenter Business Analyst - Mammoth Proctored Exam test questions that will help you more.

Succeed Insurance has a strategic initiative to offer pay-as-you-drive personal auto insurance to compete with other large carriers. Customers who choose these policies must either own a vehicle that is equipped with a monitoring device or agree to install a device provided by Succeed. The monitoring device collects information about how the drivers of a covered vehicle drive, including how fast they drive, how hard they brake, and how many miles/kilometers the vehicle travels within a policy period.

This information is logged, and premiums are based on how the insured's driving behavior is categorized. When a claim is reported, the log files must be obtained to analyze the information captured by the monitoring device at the time of the incident.

Succeed plans to collect and evaluate the Vehicle Monitoring Log files in the first implementation phase, which is scheduled for release in 60 days. The project sponsors have instructed the implementation team to use base product functionality over customization. Integration should be leveraged where possible to avoid manual data entry.

No payments can be made on the claim until a flag indicating that the Vehicle Monitoring Log file has been processed has been set to 'Yes'.

Which feature of the base product prevents payments from being made on the claim?

During claim intake and adjudication, Adjusters capture contact information for the insured and all claimants. To improve customer service and reduce the time required to reach these contacts to gather additional claim information, Succeed Insurance will capture the preferred contact method for all person contacts. The new field will be added to the contact details screen of the user interface (UI) as a drop-down list displaying all valid contact methods including email, mail, and phone.

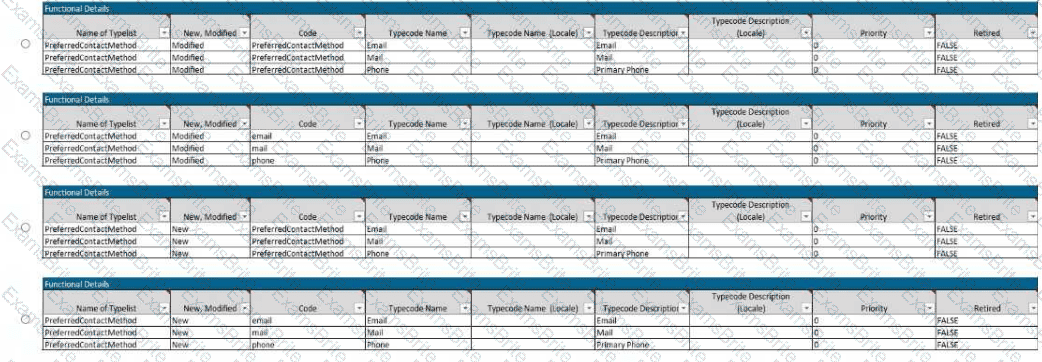

Which version correctly lists the preferred contact methods in the Typelists tab of the Parties Involved User Story Card?

Which two best practices should a Business Analyst (BA) follow to be prepared for a Requirements Workshop? (Choose two.)

Succeed Insurance needs the ability to associate a primary hospital with an injury incident if the injured party received treatment. When treatment is needed, the primary hospital name should display on the injury incident screen along with other details about the injury and treatment received.

The primary hospital should be added to the injury incident in one of the following ways:

. Select the name from a list of medical care organizations already associated with the claim.

. Enter the contact details directly in the incident.

. Search the Address Book from the incident to locate a hospital.

Which two requirements must be documented to associate the primary hospital with the claim? (Choose two.)

Succeed Insurance is expanding into California, Texas, and Arizona which have large Spanish-speaking customer bases. Currently language is not considered in assignment. Succeed wants the ability to assign claims to appropriate bilingual Adjusters. Succeed also needs the ability to identify the preferred language of the customers.

The company is planning to implement a slightly modified version of ClaimCenter to suit its organization's needs. The modification will include adding two new required fields to the existing user interface (UI) to capture the reporter's Preferred Language and Preferred Contact Time. This requirement is critical for Succeed to enhance the operational efficiency and expediency of claims processing in its region.

Which two guiding principles apply to this implementation? (Choose two.)

A sales executive and business traveler has a full coverage auto policy through his insurance company. The executive lives in Detroit, Michigan and often drives across the border to visit client offices in Canada.

While driving in downtown Toronto, the executive's car was hit by a truck coming the wrong way. He called his insurance company to report a claim for this accident. However, the Customer Service Representative (CSR) cannot confirm there is an active policy on file.

How should this claim be handled?

Succeed Insurance allows field Adjusters to write checks directly to the insured to cover damage costs for minor claims such as:

Personal auto claims involving cracked windshields

Homeowners claims involving minor glass breakage

The Adjuster uses the Manual Check Wizard to record the check number and amount against a reserve line. Succeed requires Supervisor approval for all manual checks to ensure that the paper checks are verified against the payment information in ClaimCenter.

Which two limits or rules must be configured in ClaimCenter to ensure that these manual payments are sent to the correct person for approval? (Choose two.)

When creating a new Personal Auto claim, Succeed Insurance would like to identify when Rideshare is the primary use for a vehicle. A Business Analyst (BA) thinks that Primary Use already exists as a typekey on the Vehicle Details screen.

What are two ways the BA can confirm whether this field is configured in ClaimCenter and, if it is, which values are available in the typelist? (Choose two.)

A commercial auto claims group at Succeed Insurance has a large number of overdue activities related to service requests. Reviewing the distribution of these activities across the team, the supervisor sees that one Adjuster on the team owns only one of these activities, while the other Adjusters own five or six.

To expedite completion of these activities, the Supervisor decides that the Adjuster with one service request activity will handle all of the overdue service activities for the team.

Which screen can the Supervisor use to most efficiently reassign these service request activities?

A claim for an auto accident in California has been assigned to an insurance Adjuster in the Midwest region for investigation and processing. The claim has been flagged as "Low Complexity" in ClaimCenter. The Adjuster has an authority limit for total reserves of $30,000 and has created reserves totaling $35,000.

What is the correct approval routing for this transaction?

A claim for an auto accident in Tampa, Florida has been reported and recorded in ClaimCenter. The ClaimCenter base product Global Claim Assignment Rule is utilized for automatic assignment to Adjusters regardless of complexity of claims.

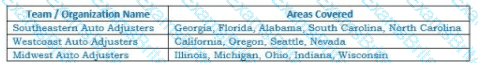

What is the likely path of assignment for this claim?

Succeed Insurance is implementing a slightly modified version of ClaimCenter to suit its organization's needs. The modification will include adding two new required fields to the standard user interface to capture the reporter's Preferred Language and Preferred Contact Time. This requirement is critical for Succeed to improve efficiency and the expediency of claims processing in its region.

Under which ClaimCenter theme will the User Story Card be found for documenting these requirements?

Which workflow will kick in if the claim assignment is handled via "Default Group Claim Assignment Rule" with available matching?

A car accident in a rural area of Durango, Colorado is reported to Succeed Insurance. The driver of the damaged car reportedly hit the base of a windmill tower while driving at night. There was no other passenger in the car when the accident happened, and the driver has a valid auto policy on file.

While the driver is not physically injured, the entire passenger side of the car has been severely damaged. Although the windmill is still functioning, the base of the tower has sustained multiple broken parts.

Which two incidents need to be created for the claim based on the reported accident? (Choose two.)

Which two actions may the Business Analyst (BA) perform based on the roles and permissions functionality of ClaimCenter? (Choose two.)